Recycled Polyethylene for Sustainable Flexible Packaging Market Cost & Price Analysis, Key Players, Technology Trends, and Regional Outlook (2025–2035)

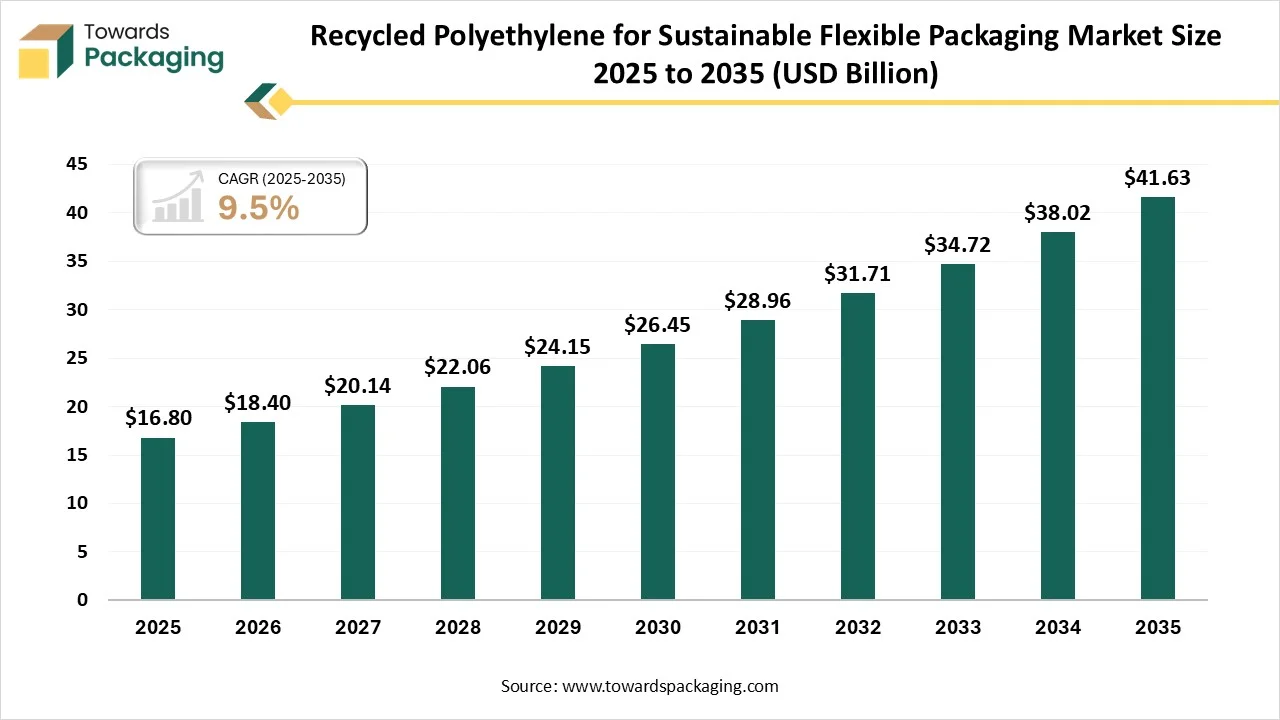

According to Towards Packaging consultants, the global recycled polyethylene for sustainable flexible packaging market is projected to reach approximately USD 41.63 billion by 2035, increasing from USD 16.80 billion in 2025, at a CAGR of 9.5% during the forecast period 2026 to 2035.

Ottawa, Feb. 13, 2026 (GLOBE NEWSWIRE) -- The global recycled polyethylene for sustainable flexible packaging market reached approximately USD 16.80 billion in 2025, with projections suggesting it will climb to USD 41.63 billion in 2035, according to a report from Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

Market Insights: Recycled Polyethylene for Sustainable Packaging

The recycled polyethylene market for flexible packaging is set for continued growth, driven by increasing consumer and regulatory demand for sustainable solutions. The following are key metrics and insights into the market's current and projected future state:

| Data Category | Actual Value / Reported Figure | Context / Notes |

| Market Value (2025) | USD 16.8 billion | The projected value of the recycled polyethylene market for sustainable flexible packaging in 2025. |

| Market Value in 2026 | USD 18.4 billion | Expected market size for recycled PE in 2026, reflecting ongoing growth in sustainable packaging adoption. |

| Dominant Regional Market (2025) | Asia Pacific | Asia Pacific is expected to lead the market due to regulatory pushes and growing demand from food & beverage and e-commerce sectors. |

| Top Exporters of Recycled Plastics | Vietnam (3,849 shipments), US (2,855), China (1,683) | Key exporters of recycled plastics, reflecting global supply chains for recycled PE. |

| Dominant Material Type (rPE) | rHDPE largest market share | High-density recycled PE is expected to dominate the flexible packaging market, especially for rigid containers and films. |

| Secondary Growth Material | rLDPE rising segment | Recycled LDPE is expected to grow faster due to its flexibility and moisture resistance, key traits for packaging applications. |

| Leading Recycling Technology (2025) | Mechanical recycling | The most widely used recycling method for processing recycled PE in packaging, known for its scalability. |

| Advanced Technology Trend | Chemical recycling segment growth | Chemical recycling is gaining importance for handling more complex plastics that cannot be processed through traditional mechanical recycling methods. |

| Primary End Use Segment | Food & Beverage packaging lead | The largest reuse segment for recycled polyethylene packaging, driven by the need for shelf life and protective packaging for food products. |

Key Insights:

- Asia Pacific continues to dominate the recycled PE market due to regulatory incentives and strong demand from the food and beverage and e-commerce sectors.

- The food and beverage segment is the largest application for recycled polyethylene, driven by the need for packaging that maintains product quality and extends shelf life.

-

Chemical recycling is emerging as an important technology trend, offering solutions for more complex plastic waste and complementing traditional mechanical recycling.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5953

What is meant by Recycled Polyethylene for Sustainable Flexible Packaging?

Recycled polyethylene for sustainable flexible packaging refers to polyethylene resins recovered from post-consumer or post-industrial plastic waste and reprocessed for use in flexible packaging applications such as pouches, films, and wraps. The market is driven by rising sustainability commitments, stricter plastic regulations, growing consumer preference for eco-friendly packaging, and technological advances that improve recycled material quality, safety, and performance across diverse end-use industries.

Manufacturing Cost Trends for Recycled Polyethylene (rPE)

The manufacturing costs for recycled polyethylene (rPE), which is used in sustainable flexible packaging, vary based on the grade of the polymer, feedstock quality, and the recycling technology used. The following table presents the typical manufacturing cost ranges for recycled PE production.

Manufacturing Cost Range for Recycled Polyethylene (USD/tonne)

| Year | Low (USD/tonne) | High (USD/tonne) | ||

| 2020 | $ | 500 | $ | 900 |

| 2021 | $ | 520 | $ | 930 |

| 2022 | $ | 540 | $ | 970 |

| 2023 | $ | 560 | $ | 1,000 |

| 2024 | $ | 580 | $ | 1,030 |

| 2025 | $ | 600 | $ | 1,060 |

| 2026 | $ | 620 | $ | 1,100 |

| 2027 | $ | 640 | $ | 1,140 |

| 2028 | $ | 660 | $ | 1,180 |

| 2029 | $ | 690 | $ | 1,230 |

| 2030 | $ | 720 | $ | 1,280 |

| 2031 | $ | 750 | $ | 1,330 |

| 2032 | $ | 780 | $ | 1,380 |

| 2033 | $ | 810 | $ | 1,430 |

| 2034 | $ | 840 | $ | 1,490 |

| 2035 | $ | 870 | $ | 1,550 |

Key Insights:

- Low-end prices (~$500/tonne) typically reflect the cost of simpler recycled PE grades, such as those with lower levels of post-consumer recycled (PCR) content and basic mechanical recycling.

- High-end prices (~$1,550/tonne) are associated with premium clean recycled resins, which offer higher transparency, better melt flow, and higher levels of PCR content.

- The steady rise in costs over the years reflects the increasing complexity of recycling processes, higher quality requirements, and inflationary pressures on materials and energy costs.

Selling Price Trends for Recycled Polyethylene (rPE) in Flexible Packaging

The selling prices for recycled polyethylene reflect added value, including the cost of logistics, supply chain handling, certification (e.g., PCR content), and premium pricing for high-quality grades. The following table outlines the selling prices that packaging converters typically pay for recycled PE used in flexible packaging production.

Selling Price Range for Recycled Polyethylene (USD/tonne)

| Year | Low (USD/tonne) | High (USD/tonne) | ||

| 2020 | $ | 800 | $ | 1,300 |

| 2021 | $ | 840 | $ | 1,350 |

| 2022 | $ | 880 | $ | 1,400 |

| 2023 | $ | 920 | $ | 1,460 |

| 2024 | $ | 960 | $ | 1,520 |

| 2025 | $ | 1,000 | $ | 1,580 |

| 2026 | $ | 1,050 | $ | 1,650 |

| 2027 | $ | 1,100 | $ | 1,720 |

| 2028 | $ | 1,160 | $ | 1,790 |

| 2029 | $ | 1,220 | $ | 1,870 |

| 2030 | $ | 1,280 | $ | 1,950 |

| 2031 | $ | 1,350 | $ | 2,040 |

| 2032 | $ | 1,420 | $ | 2,130 |

| 2033 | $ | 1,490 | $ | 2,230 |

| 2034 | $ | 1,570 | $ | 2,340 |

| 2035 | $ | 1,650 | $ | 2,460 |

Key Insights:

- Selling prices for recycled PE are higher than manufacturing costs due to value-added processing, logistics, quality sorting, and certification, such as higher PCR content.

- Premium grades with higher transparency, better melt flow, and consistent performance command the higher range prices.

Key Players in Recycled Polyethylene for Sustainable Packaging

The recycled polyethylene market is being led by several large players involved in sustainable packaging solutions, including flexible packaging for food, beverages, and consumer goods. Below is a list of major companies actively participating in the recycled PE market:

| Company | Revenue (Most Recent) | Employees | Recycled PE / Sustainable Packaging Focus | Additional Notes |

| Amcor plc | ~US$14.7B (2023) | ~44,000+ | Flexible packaging systems, including recycled content designs for PE films | A global leader in sustainable packaging, focusing on recycled content in flexible packaging for food, pharma, and consumer goods. |

| ALPLA Group | ~€5.20B (2025) | ~25,440 | Produces sustainable plastic packaging and regenerates plastics including recycled PE films | ALPLA is investing heavily in recycling infrastructure and has 206 plants across 45 countries. |

| Berry Global Inc. | ~US$16.6B (2024 est.) | ~48,000 | Flexible and rigid packaging solutions with increasing recycled PE content | A key player in the flexible packaging sector, focusing on sustainable solutions and incorporating recycled PE in a wide range of applications. |

| Mondi plc | ~€7.5B (2024 est.) | ~25,000 | Provides sustainable flexible packaging solutions, including recycled PE components | Active in both European and global markets, specializing in recycled PE for various end-use applications, including food and beverage packaging. |

| Constantia Flexibles | ~€3.1B (2023) | ~9,000 | Flexible & laminated heat-sealable packaging | Focused on providing high-barrier heat-seal solutions in pharma and food packaging. |

| Sealed Air Corporation | ~US$5.4B (2023) | ~16,500 | Flexible packaging solutions, with emphasis on reducing plastic waste and incorporating recycled plastics | Known for Cryovac brand, focusing on sustainable packaging in the food industry. |

| Sonoco Products Company | ~US$7.4B (2024 est.) | ~20,000+ | Flexible packaging with recycled PE options for consumer goods and industrial segments | A major global packaging company with a strong presence in flexible packaging using recycled PE. |

Key Insights:

- Amcor, Berry Global, and ALPLA are major global leaders in sustainable packaging, integrating recycled polyethylene (rPE) into their solutions.

- Sealed Air Corporation and Sonoco Products emphasize recycled PE in their flexible packaging solutions, with a strong focus on reducing plastic waste and increasing sustainability.

Private Industry Investments for Recycled Polyethylene for Sustainable Flexible Packaging:

- Dow and Lucro Plastecycle Partnership: These companies developed post-consumer recycled (PCR) polyethylene film solutions specifically designed to close the loop for flexible packaging in the Indian market.

- Deluxe Recycling Facility Expansion: Deluxe Recycling inaugurated India's largest multi-layered plastic (MLP) plant in Gujarat to process flexible packaging waste into high-value industrial applications.

- Amcor and Berry Global Merger: This $13 billion merger created a global leader focused on accelerating the development of recyclable mono-material polyethylene and polypropylene films.

- Re Sustainability and Aarti Circularity Joint Venture: These firms invested ₹100 crore ($12M) to establish large-scale recycling facilities across India focused on converting plastic waste into circular materials.

- Hindustan Unilever "Project Circular Bharat": This initiative supports dozens of startups innovating in advanced plastic recycling and next-generation sustainable packaging technologies.

- Amazon India and IIT Roorkee R&D: This partnership invested in research to develop recyclable paper-based mailers from agricultural residues as a high-performance alternative to traditional plastic flexible packaging.

-

Oroville Flexible Packaging System: Launched by RE:CIRCLE Solutions, this company introduced a domestic closed-loop recycling system for flexible plastics that includes transparent audit trails for retail customers.

Recycled Polyethylene for Sustainable Flexible Packaging Market Trends

1. Growing Preference for Recyclable Mono-Material Packaging

Flexible packaging producers are increasingly shifting toward mono-material polyethylene structures to improve recyclability. Using a single polymer type reduces sorting complexity and material loss during recycling. This trend supports circular packaging design, helps brands meet recyclability commitments, and improves recovery rates without compromising the flexibility, strength, or lightweight performance required in modern packaging applications.

2. Continuous Improvement in Recycling Technologies

Advancements in recycling methods are significantly enhancing the quality of recycled polyethylene used in flexible packaging. Better sorting systems, cleaner washing processes, and improved reprocessing techniques are reducing contamination and improving resin consistency. These developments enable recycled polyethylene to achieve higher performance standards, allowing its use in more demanding applications that previously relied on virgin materials.

3. Stronger Regulatory and Environmental Pressure

Governments and environmental bodies are tightening regulations around plastic waste management and recycled content usage. Policies promoting extended producer responsibility and plastic reduction are pushing packaging manufacturers to increase recycled polyethylene adoption. These regulatory drivers are encouraging innovation in sustainable packaging design while accelerating the transition away from virgin plastics across global markets.

4. Rising Demand for High-Quality and Certified Recycled Content

Packaging buyers increasingly seek recycled polyethylene that offers traceability, consistency, and verified sustainability attributes. Higher expectations around material quality and compliance are encouraging the development of premium recycled resins suitable for flexible packaging. This trend supports brand sustainability goals while building confidence in recycled materials among manufacturers and end users.

5. Expanding Use Across High-Volume Packaging Applications

The adoption of recycled polyethylene is growing across food packaging, personal care products, and e-commerce applications. These sectors require lightweight, durable, and flexible materials, making polyethylene an ideal choice. The combination of performance benefits and environmental advantages is accelerating its integration into mainstream flexible packaging solutions worldwide.

Recycled Polyethylene for Sustainable Flexible Packaging Industry Potential

The recycled polyethylene for sustainable flexible packaging industry is projected to grow at a healthy and consistent pace over the coming years. Growth is supported by rising sustainability commitments from brand owners, expanding recycling infrastructure, and increasing acceptance of recycled materials in flexible packaging. Ongoing regulatory support and continuous improvements in recycled resin quality are further strengthening long-term market expansion.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Regional Analysis:

Who is the leader in Recycled Polyethylene for Sustainable Flexible Packaging Market?

The Asia-Pacific region leads the recycled polyethylene for sustainable flexible packaging industry due to rapid industrialization, increasing packaging demand from the food, retail, and e-commerce sectors, and a strong government emphasis on plastic waste reduction. Growing awareness of sustainability, expanding recycling infrastructure, lower production costs, and supportive policies encouraging recycled content adoption further strengthen the region’s position as a dominant market for eco-friendly flexible packaging materials.

China Recycled Polyethylene for Sustainable Flexible Packaging Market Trends

China’s strength in the recycled polyethylene for sustainable flexible packaging industry lies in its large-scale manufacturing ecosystem, well-developed plastic collection and processing networks, and strong push toward circular economy practices. High domestic demand for flexible packaging across food, retail, and e-commerce supports continuous material uptake.

Additionally, cost-efficient production, improving recycling technologies, and supportive environmental policies enable China to dominate the Asia-Pacific market and influence regional supply chains.

North America in the Recycled Polyethylene for Sustainable Flexible Packaging Industry

The rise of North America in the recycled polyethylene for sustainable flexible packaging industry is driven by strong sustainability commitments from brands, increasing consumer demand for environmentally responsible packaging, and strict regulations on plastic waste reduction. Advanced recycling infrastructure, technological innovation, and high adoption of recycled-content packaging across food, retail, and e-commerce sectors further create significant opportunities for long-term market growth in the region.

U.S. Recycled Polyethylene for Sustainable Flexible Packaging Market Trends

In 2025, the U.S. market is shaped by strong brand-led sustainability targets, increasing use of recycled content in everyday packaging, and rising consumer awareness around plastic waste. Food, personal care, and e-commerce sectors are accelerating the adoption of flexible packaging made with recycled polyethylene. Continuous improvements in domestic recycling systems, material performance, and packaging design are enabling faster and more reliable growth across the U.S. market.

How Big is the Opportunity for Growth of the Europe Region in the Market?

Europe offers significant growth potential for recycled polyethylene in sustainable flexible packaging due to strong environmental regulations and circular-economy initiatives. Government mandates on recycled content and packaging recyclability are encouraging manufacturers and brand owners to shift toward recycled materials. Rising demand for eco-friendly packaging, growth in e-commerce, and increasing corporate sustainability goals are further supporting adoption across food, personal care, and retail applications, making the region a key market for recycled PE solutions.

More Insights of Towards Packaging:

- South Korea Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Germany Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Cosmetic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- U.S. Glass Packaging Market Size and Segments Outlook (2026–2035)

- Flexible Packaging Adhesive Market Size, Trends and Regional Analysis (2026–2035)

- France Pharmaceutical Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Japan Packaging Machinery Market Size, Trends and Competitive Landscape (2026–2035)

- Repackaging Service Market Size and Segments Outlook (2026–2035)

- Corrugated Automotive Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Barrier-Coated Flexible Paper Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Bio-Based Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Active and Intelligent Packaging Market Size and Segments Outlook (2026–2035)

- Plain Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Waste Management Market Size, Trends and Competitive Landscape (2026–2035)

- Track and Trace Packaging Market Size, Trends and Segments (2026–2035)

- Single-Use Plastic Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Unbleached Kraft Paperboard Market Size, Trends and Segments (2026–2035)

- Egg Boxes and Trays Market Size and Segments Outlook (2026–2035)

- Corrugated Packaging for Pharmaceutical Market Size, Trends and Competitive Landscape (2026–2035)

Segment Outlook

Material Type Insights

The recycled high-density polyethylene segment (rHDPE) dominates the recycled polyethylene for sustainable flexible packaging market due to its superior strength, durability, and moisture resistance. Its ability to maintain performance while incorporating recycled content makes it suitable for heavy-duty pouches, liners, and films. Widespread availability of HDPE waste streams and consistent recycling outcomes further support its leading position.

The recyclable low-density polyethylene (rLDPE) segment is the fastest-growing segment in the market due to its high flexibility, lightweight nature, and suitability for modern flexible packaging formats. Growing demand for squeezable pouches, wraps, and films, combined with improved recyclability and better material quality, is accelerating adoption across food, personal care, and retail packaging applications.

Recycling Technology Type Insights

Mechanical recycling is the dominant segment in the recycled polyethylene for sustainable flexible packaging market due to its cost efficiency, mature infrastructure, and wide commercial adoption. It allows large volumes of polyethylene waste to be processed into usable recycled resin with relatively low energy consumption. Established collection systems and consistent output quality further support its strong market presence.

The advanced/chemical recycling segment is the fastest-growing segment in the recycled polyethylene terephthalate flexible packaging market due to its ability to handle contaminated and mixed plastic waste. This process breaks PET down to its molecular level, enabling near-virgin quality output. Rising demand for high-purity recycled PET and circular packaging solutions is accelerating adoption across flexible packaging applications.

End-Use Industry Insights

The food & beverage packaging segment dominates the recycled polyethylene for sustainable flexible packaging market due to high consumption volumes and the strong need for lightweight, durable, and protective packaging solutions. Recycled polyethylene offers moisture resistance, flexibility, and improved sustainability, making it suitable for pouches, wraps, and liners. Growing demand for sustainable food packaging and increasing regulatory focus on recycled content further reinforce the segment’s dominant position.

The e-commerce & retail packaging segment is the fastest-growing end-use industry in the market. Rising online shopping and direct-to-consumer deliveries are driving demand for lightweight, durable, and protective packaging. Recycled polyethylene provides sustainable, flexible solutions that reduce environmental impact while maintaining product safety, making it increasingly preferred in modern e-commerce and retail packaging applications.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in Recycled Polyethylene for Sustainable Flexible Packaging Industry

- In February 2026, at PLASTINDIA 2026, UFlex Limited, the largest multinational flexible packaging and solutions company in India, planned to introduce a variety of cutting-edge solutions spanning the packaging value chain. These solutions are expected to address important industry priorities like recyclable PET resin, high-performance chemicals, advanced machinery, innovative films, precision printing cylinders, and EPR-compliant sustainable solutions.

- In June 2025, UFlex, India’s largest multinational flexible packaging company, unveiled its latest innovation: an FSSAI‑compliant single‑polymer solution for incorporating recycled PET into food and beverage packaging. Designed to maintain safety and performance standards, the new material simplifies recycling while meeting stringent regulatory requirements.

Top Companies in the Global Recycled Polyethylene for Sustainable Flexible Packaging Market

Tier 1:

- Amcor plc: Offers AmPrima® recycle-ready films that incorporate up to 100% PCR content for food and personal care.

- Berry Global, Inc.: Produces Sustane® recycled polymers and pouches containing 30% FDA-compliant recycled resin.

- Borealis AG: Markets Borcycle™ M rPE with up to 85% PCR for non-food use and renewable-based polyolefins for food-contact films.

- Sealed Air Corporation: Manufactures BUBBLE WRAP® brand packaging with 80% recycled content and invests in chemical recycling for food-grade films.

- UFlex Limited: Produces Asclepius™ films containing up to 100% PCR content via proprietary plastic waste recycling plants.

- Indorama Ventures: Supplies high-quality recycled polyolefin resins designed to be blended into various flexible film structures.

- Dow Inc.: Provides REVOLOOP™ recycled resins used in mono-material PE films for collation shrink and secondary packaging.

- ExxonMobil Chemical: Utilizes Exxtend™ advanced recycling technology to produce certified circular polyethylene for high-performance food-grade packaging.

Tier 2:

- LyondellBasell Industries

- SABIC

- ALPLA Group

- Constantia Flexibles

- Sonoco Products Company

- Mondi Group

- Plastipak Holdings, Inc.

- Pashupati Group

- ProAmpac

- KW Plastics

- UFlex Recycling Division

- GCR (Global Circular Resins / recycled plastics producer)

Global Recycled Polyethylene for Sustainable Flexible Packaging Market

By Material Type

- Recycled High-Density Polyethylene (rHDPE)

- Food-Grade rHDPE

- Industrial-Grade rHDPE

- Virgin-rHDPE Blends

- Recycled Low-Density Polyethylene (rLDPE)

- Film-Grade rLDPE

- Bag-Grade rLDPE

- Virgin-rLDPE Blends

- Recycled Linear Low-Density Polyethylene (rLLDPE)

- Film Applications

- Flexible Packaging Applications

- Blended rLLDPE

- Recycled Ultra-High Molecular Weight PE (rUHMWPE)

- High-Strength Packaging

- Industrial Packaging Applications

- Blends of Recycled PE Grades

- rHDPE + rLDPE Blends

- rHDPE + rLLDPE Blends

- Multi-Grade Recycled PE Blends

By Recycling Technology

- Mechanical Recycling

- Extrusion & Reprocessing

- Pelletizing & Compounding

- Melt Filtration & Cleaning

- Advanced / Chemical Recycling

- Depolymerization Processes

- Pyrolysis / Thermal Conversion

- Solvent-Based Recycling

By End-Use Industry

- Food & Beverage

- E-commerce & Retail Packaging

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Household & Homecare

- Industrial & Specialty Packaging

By Region

North America:

- U.S.

- Canada

- Mexico

- Rest of North America

South America:

- Brazil

- Argentina

- Rest of South America

Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5953

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Sanitary Food and Beverage Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ready-to-Use Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Size, Trends and Competitive Landscape (2026–2035)

- Asia Pacific Food Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Europe Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- North America Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- North America Post-Consumer Recycled Plastics Food Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Transfer Molded Pulp Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Food Packaging Market Size and Segments Outlook (2026–2035)

- Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

- North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

- Next-Generation Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Recycled Materials Packaging Solutions Market Size and Segments Outlook (2026–2035)

- Commercial Printing Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Films Market Size and Segments Outlook (2026–2035)

- Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

- Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.