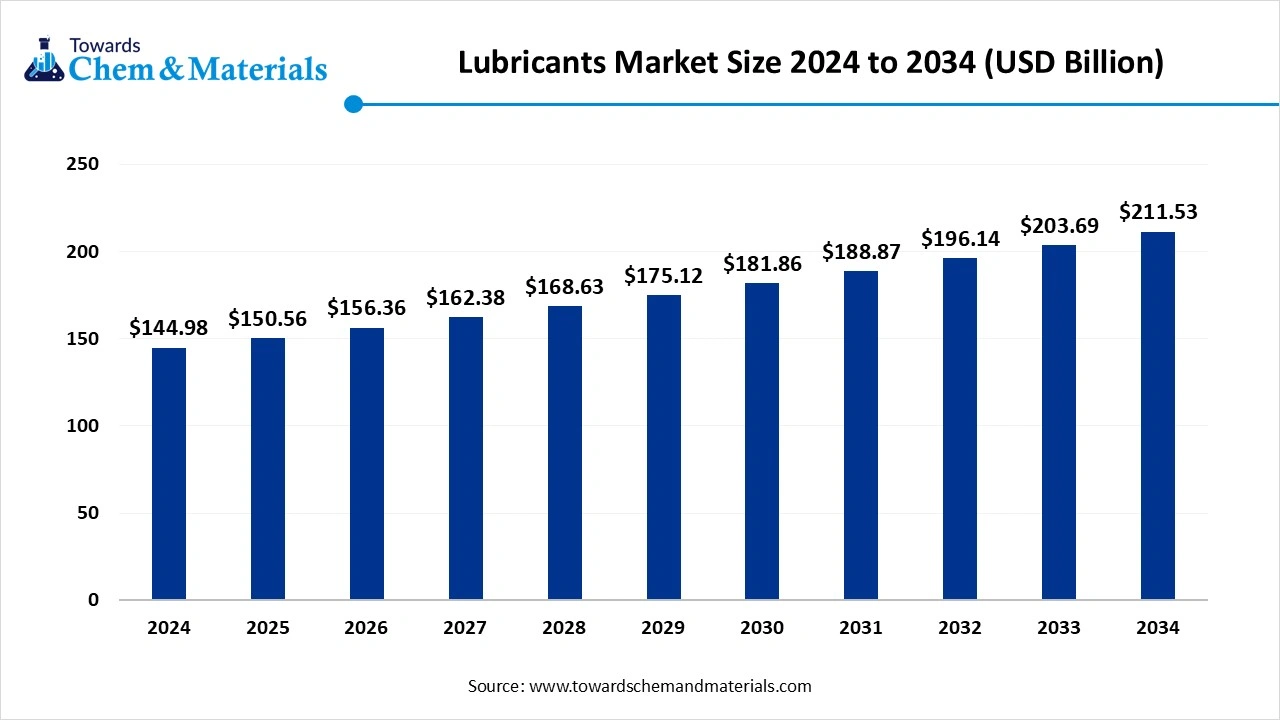

Lubricants Market Size to Worth USD 211.53 Billion by 2034

According to Towards Chemical and Materials, the global lubricants market size is calculated at USD 150.56 billion in 2025 and is expected to be worth around USD 211.53 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.85% over the forecast period 2025 to 2034.

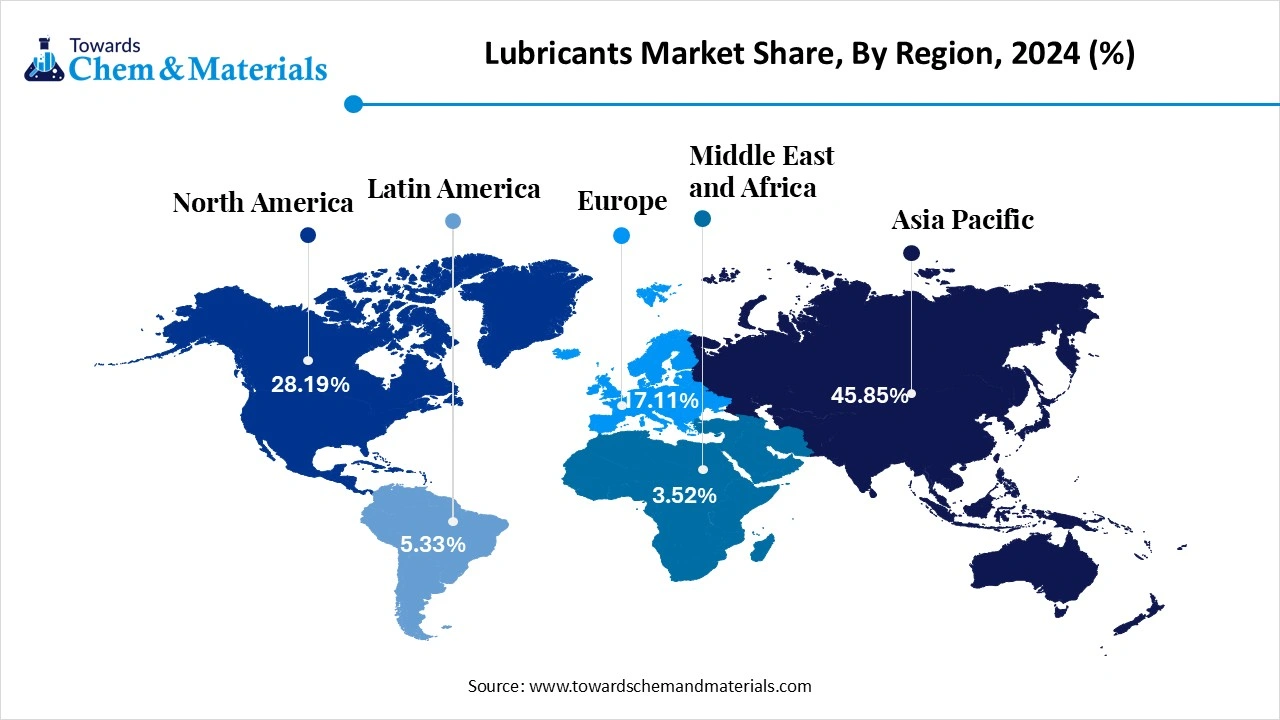

Ottawa, Nov. 13, 2025 (GLOBE NEWSWIRE) -- The global lubricants market size was valued at USD 144.98 billion in 2024 and is anticipated to reach around USD 211.53 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.85% over the forecast period from 2025 to 2034. Asia Pacific dominated the Lubricants market with a market share of 45.85% in 2024. The growing demand for high performance and synthetic lubricants in the automotive and industrial sectors is a key factor driving the growth of the lubricants market. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5648

What are Lubricants?

The global lubricants market is evolving steadily, driven by sustained demand from the automotive and industrial sectors alongside technological advancements in lubricant formulations. The market is shaped by factors such as rapid industrialization in emerging economies, increasing vehicle production, and a growing focus on high-performance and synthetic lubricants.

At the same time, the market faces challenges tied to stricter environmental regulations, the transition to electric and hybrid vehicles, and changing base oil dynamics, all of which prompt manufacturers to innovate and adjust product portfolios.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

Lubricants Market Report Highlights

- The global lubricants market was valued at USD 144.98 billion in 2024.

- It is estimated to reach around USD 150.56 billion in 2025.

- The market is projected to grow to approximately USD 211.53 billion by 2034.

- This reflects a compound annual growth rate (CAGR) of about 3.85% during 2025-2034.

- The Asia Pacific region dominated the market in 2024 with a 45.85% share.

- Asia Pacific dominated the lubricants market with a revenue share of 45.85% in 2024.

- The China lubricants market is projected to grow during the forecast period.

- By product, the mineral oil segment accounted for the largest revenue share of 64.78% in 2024.

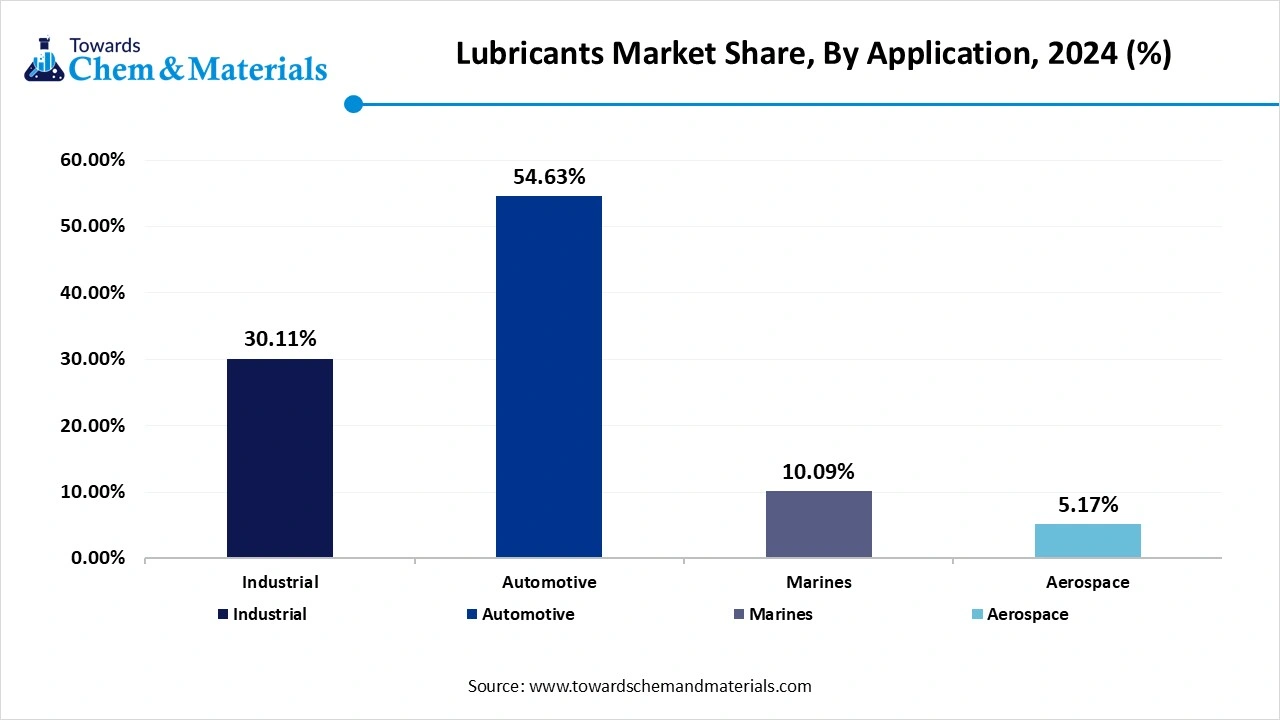

- By application, the automotive segment dominated with the largest revenue share of 54.63% in 2024.

- The Top Key companies Profiled, ExxonMobil Corp.; Royal Dutch Shell Co.; BP PLC; Total Energies; Chevron Corp.; Fuchs; Castrol India Ltd.; Amsoil Inc.; JX Nippon Oil & Gas Exploration Corp.; Philips 66 Company; Valvoline LLC; PetroChina Company Ltd.; China Petrochemical Corp

Major Sustainability Trends in the Lubricants Industry:

- Shift to Bio-based and Biodegradable Lubricants: The industry is moving towards lubricants derived from renewable sources like vegetable oils that minimize environmental impact upon release.

- Improved Energy Efficiency and Fuel Economy: Advanced, low-friction lubricant formulations are being developed to reduce energy consumption and lower greenhouse gas emissions in engines and machinery.

- Circular Economy Practices and Re-refining: Companies are increasingly focused on collecting and re-refining used oils into new products, conserving resources and minimizing waste through recycling.

- Stricter Environmental Regulations and Standards: New regulations are driving the mandatory adoption of environmentally acceptable lubricants (EALs) in sensitive areas, pushing the industry toward compliance and innovation.

-

Digitalization for Optimized Usage: IoT and data analytics are used to optimize lubricant lifespan through condition monitoring and predictive maintenance, reducing overall consumption and waste.

What Are the Major Trends in the Lubricants Market?

- Rising adoption of synthetic and bio-based lubricants to meet increasing demands for high performance and sustainability.

- The growing influence of environmental regulations and the electrification of transport is prompting reformulation and innovation in lubricant products.

- Strong demand growth from industrial end-use sectors such as manufacturing, mining, construction, and power generation is driving increased lubricant consumption.

- Shift in regional demand dynamics, with rapid industrialization and vehicle ownership in the Asia Pacific and rising premium product uptake in mature markets.

Immediate Delivery Available | Buy This Premium Research Report https://www.towardschemandmaterials.com/checkout/5648

Lubricants Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 150.56 Billion |

| Revenue forecast in 2030 | USD 211.53 Billion |

| Growth rate | CAGR of 3.85% from 2025 to 2030 |

| Base year for estimation | 2024 |

| Historical data | 2018 - 2023 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Volume in kilo tons, revenue in USD million/billion, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

| Segments covered | Product, application, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

| Key companies profiled | ExxonMobil Corp.; Royal Dutch Shell Co.; BP PLC; Total Energies; Chevron Corp.; Fuchs; Castrol India Ltd.; Amsoil Inc.; JX Nippon Oil & Gas Exploration Corp.; Philips 66 Company; Valvoline LLC; PetroChina Company Ltd.; China Petrochemical Corp.; Idemitsu Kosan Co. Ltd.; Lukoil; Petrobras; Petronas Lubricant International; Quaker Chemical Corp.; PetroFer Chemie; Buhmwoo Chemical Co. Ltd.; Zeller Gmelin Gmbh & Co. KG; Blaser Swisslube Inc. |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Types of Lubrication

Understanding the different lubrication regimes is critical to selecting the right lubricant oil. The three main lubrication regimes are:

Boundary Lubrication : It occurs when two surfaces directly interact with a thin lubricant film in between. It is common in highly loaded, slow-moving parts and requires robust oil additives that protect by bonding to metal surfaces. Examples of this regime are gear tooth contact or cam-tappet contact in engines.

Mixed Lubrication : Involves partial separation between surfaces. The asperities of surfaces occasionally make contact and get separated. Oils with additives like Extreme Pressure (EP) additives and Anti-Wear (AW) additives will help protect the surface in this regime. This is observed when the sliding speed of the surfaces increases, such as in piston-ring and liner contacts in the engine.

Hydrodynamic Lubrication : It occurs when the lubricant film completely separates the surfaces. It is prevalent in journals and bearings. High-viscosity fluids are needed to form thick films.

Types of Lubricating Oils :

Numerous speciality lubricant oils cater to particular applications. But based on the nature of the base oil used to make them, they fall under four broad categories:

Mineral Oils ; They are derived from petroleum crude oil. They offer good viscosity characteristics and cost benefits. They are extensively used in engine oils, gear oils and hydraulic oils.

Synthetic Oils : These are generally produced by chemically modifying crude oil molecules or artificially synthesising organic compounds. These oils display excellent viscosity-temperature properties, resistance to heat and oxidation and sludge buildup.

Semi-Synthetic Oil : These oils contain a combination of both mineral and synthetic oils and have superior viscosity behaviour when compared to a full mineral oil, particularly at lower temperatures.

Bio-based Oils : They are manufactured from natural fats and are 100% renewable and biodegradable. They have improved lubricity when compared to mineral oils. Have viscosity and lubricity comparable to mineral oils.

How Does AI Influence the Growth of the Lubricants Industry in 2025?

Artificial intelligence is influencing the lubricants industry in 2025 by enabling smarter formulation processes, predictive maintenance, and efficient supply chain management. Through AI-driven analytics, manufacturers can optimise lubricant performance, reduce waste, and predict equipment needs before failures occur. This enhances product reliability and operational efficiency across industries, supporting a shift toward data-based innovation and sustainable manufacturing practices.

Growth Factors

Can Digital Manufacturing Drive Lubricant Demand?

As factories embrace advanced automation and smart systems, the need for high-performance lubricants that support sophisticated machinery is growing. The integration of IoT and AI into production lines means equipment requires more reliable and tailored lubrication to maintain uptime and productivity. This shift towards interconnected, data-rich manufacturing environments is expanding opportunities for lubricant providers.

Will Eco-Friendly Lubricants shape the future?

With global pressure increasing to reduce emissions and adopt sustainable practices, industries are turning to biodegradable and low-impact lubricant formulations. The emphasis on greener manufacturing and stricter environmental standards is encouraging the development and adoption of eco-friendly alternatives. This transition is creating new growth pathways for lubricant products aligned with sustainability goals.

Market Opportunity

Could Electric Vehicle Fluids Open New Doors for Lubricants?

As electric nobility rises, there’s a growing need for specialty fluids tailored to battery cooling, gearboxes, and greases in EVs. Manufacturers are adapting their lubricant portfolios to meet these distinct thermal and electrical demands. This shift creates an opportunity for lubricant producers to expand beyond traditional engine oils and develop customised offerings.

Is Waste Oil Recycling a Smart Path for Future Lubricant Business?

Used lubricants are increasingly viewed as valuable resources rather than mere waste, thanks to improved oil recovery and refining technologies. Firms that build collection networks and reclaim base oil can tap into circular economy dynamics while reducing raw material reliance. This creates an opening for new business models centered on recycling and sustainability in the lubricant industry.

Limitations & Challenges

- Fluctuations in raw material prices restrict the expansion of the industry through increased production costs and supply chain pressure.

- Stringent environmental regulations and sustainability demands create cost and compliance burdens for lubricant manufacturers, limiting market flexibility.

Immediate Delivery Available | Buy This Premium Research Report https://www.towardschemandmaterials.com/checkout/5648

Lubricants Market Segmentation Insights

Product Insights:

Why Does the Mineral Oil Segment Dominated the Lubricants Market?

The mineral oil segment dominated the market in 2024, due to its dominance of mineral oils stems from their widespread use across automotive, industrial, and marine applications due to their established supply networks and proven performance, making them a preferred choice for both developed and developing economies. Despite the growing awareness of sustainable alternatives, mineral oils continue to hold strong market relevance because of their ability to deliver consistent lubrication under diverse operating conditions.

The synthetic oil segment is projected to experience the highest growth rate in the market between 2025 and 2024. The increasing adoption of synthetic lubricants is driven by their superior thermal stability, extended drain intervals, and ability to enhance fuel efficiency in both automotive and industrial machinery. As industries move toward sustainability and high-performance solutions, synthetic lubricants are gaining traction for their lower volatility and enhanced protection in extreme temperature conditions.

The shift in consumer preference toward premium-grade lubricants, along with the rapid expansion of modern vehicle technologies, further supports the segment’s growth. Manufacturers are also focusing on formulating synthetic oils that align with evolving emission standards, strengthening their position as the fastest-growing category in the global market.

Application Insights:

Which Application Segment Dominates the Lubricants Market?

The automotive segment dominated the market share of 54.64% in 2024, due to the large number of passenger and commercial vehicles in operation worldwide and the constant need for engine oils, transmission fluids, and greases. Continuous developments in the automotive sector, including hybrid and electric vehicles, have further expanded the scope of lubricant applications.

Additionally, the push for vehicle performance optimisation and reduced maintenance costs sustains lubricant demand in this sector. As manufacturers continue innovating with advanced lubricant formulations for fuel economy and emission control, the automotive segment remains the central driver of the global market.

The industrial segment is set to experience the fastest rate of market growth from 2025 to 2034. The growth is primarily driven by expanding manufacturing activities, infrastructure development, and increased automation across multiple industries such as metalworking, construction, and energy. Industrial lubricants are essential for improving equipment lifespan, reducing friction, and ensuring smooth operations in heavy-duty machinery.

Regional Insights

Why Is Asia Pacific Dominating the Lubricants Industry?

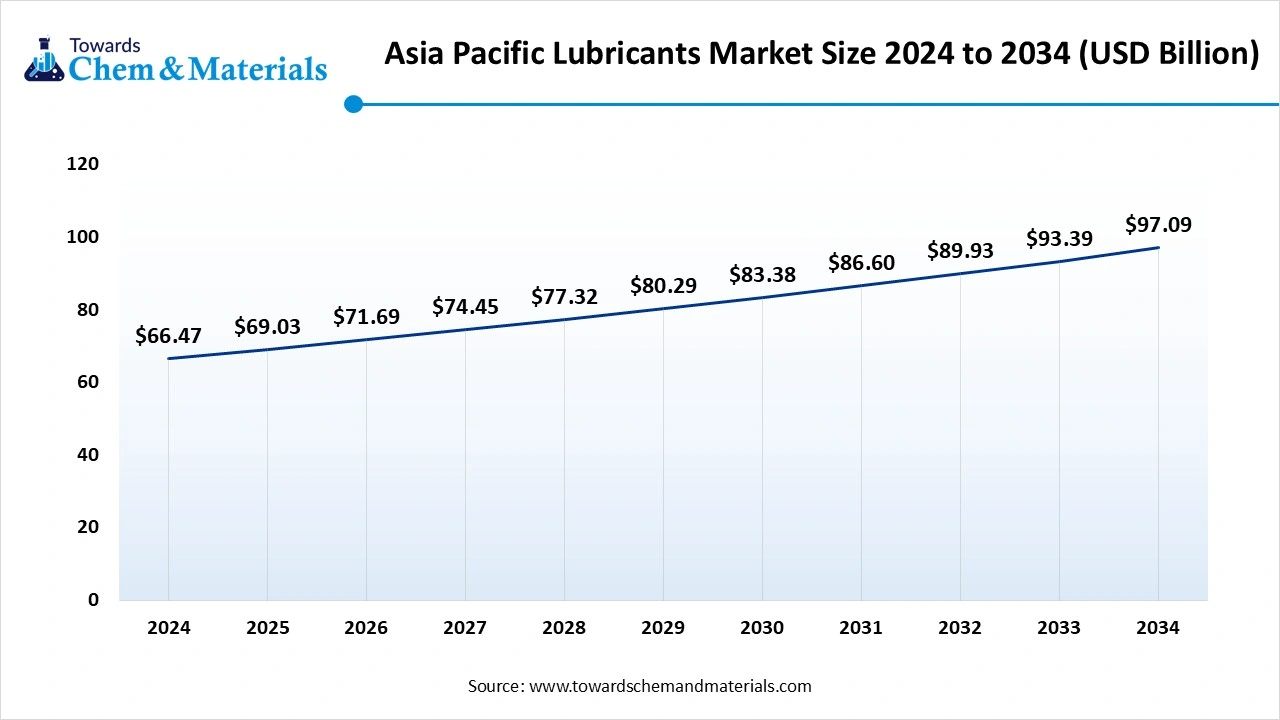

The Asia Pacific hair lubricants market is expected to increase from USD 69.03 billion in 2025 to USD 97.09 billion by 2034, growing at a CAGR of 3.86% throughout the forecast period from 2025 to 2034.

The Asia Pacific region dominated the market, owing to its rapidly expanding industrial base, extensive automotive production, and strong economic growth across major economies. Countries such as India, Japan, South Korea, and China have become manufacturing hubs for automotive and heavy machinery, creating sustained demand for high-performance lubricants across multiple sectors.

The region’s large consumer population and infrastructure development initiatives also stimulate growth in transportation and industrial machinery, both of which heavily rely on lubricant use.

China Lubricants Market Trends:

China remains the most influential market within the Asia Pacific due to its massive automotive industry, extensive manufacturing operations, and growing investment in industrial automation. Its robust domestic demand for lubricants is further supported by rising vehicle ownership and a shift toward advanced, energy-efficient formulations. Government initiatives to reduce emissions and promote cleaner technologies have encouraged local producers to innovate in synthetic and environmentally friendly lubricants.

Why is North America Growing Fastest in the Lubricants Industry?

The North America region is poised for the fastest growth in the market, driven by expanding sectors like mining, manufacturing, and construction, which increase demand for turbine oils, metalworking fluids, and hydraulic oils. Additional momentum comes from rising vehicle production, heightened adoption of synthetic and bio-based formulations under stricter environmental regulations, and a robust aerospace and maintenance industry that requires advanced lubricants.

U.S. Lubricants Market Trends

The U.S. stands out within the region thanks to its diverse industrial base, from energy and heavy manufacturing to marine and aerospace, and a large fleet of vehicles alongside growth in electric and hybrid vehicles. Strong technological infrastructure, established supply chains, and regulatory emphasis on high-performance and sustainable lubricant solutions further augment its role in the regional market.

Europe Lubricants Market Trends

Strict environmental standards, a shift toward electric and hybrid vehicles, and strong industrial demand in Germany, France, and the UK influence Europe’s lubricant industry growth. While EV adoption may dampen traditional lubricant use, it is offset by demand for specialized thermal management fluids and industrial lubricants. In addition, technological innovation and sustainability goals are driving the transition to bio-based and low-viscosity lubricants.

Latin America Lubricants Market Trends

In Latin America, rising urbanization, expanding automotive ownership, and a recovering manufacturing base are boosting lubricant demand. Countries such as Brazil and Argentina are experiencing growth in the passenger car and commercial vehicle segments, leading to increased consumption of engine oils and transmission fluids. The agricultural and mining sectors also significantly contribute to industrial lubricant usage.

Middle East & Africa Lubricants Market Trends

The MEA lubricants industry is growing due to increasing vehicle ownership, infrastructure development, and expanding oil & gas activities, especially in Gulf countries. Industrial expansion in countries such as Saudi Arabia and the UAE, along with a growing transportation fleet, supports demand for both automotive and industrial lubricants. In addition, Africa’s emerging economies are witnessing rising demand tied to the construction and mining industries.

Top Companies in the Lubricants Market & Their Offerings:

- CASTROL LIMITED: Castrol, part of the bp group, offers a wide range of "liquid engineered" high-performance oils and greases for automotive, industrial, marine, and energy sectors globally.

- FUCHS: As the world's largest independent lubricant manufacturer, FUCHS provides a comprehensive portfolio of over 10,000 specialized lubricants and related products for nearly every industry and application.

- ExxonMobil Corporation: ExxonMobil offers an extensive range of Mobil-branded industrial and automotive lubricants, including high-performance synthetic engine oils, gear oils, and greases designed to improve equipment longevity and efficiency.

- TotalEnergies: TotalEnergies produces and markets a complete line of high-performance automotive and industrial lubricants, greases, and coolants, focusing on innovation and improved fuel efficiency.

- AMSOIL INC.: AMSOIL specializes in the development and production of premium synthetic lubricants for automotive, powersports, and industrial use, known for pioneering the first API-qualified synthetic engine oil.

- Chevron Overseas Limited: Chevron offers a full line of lubricant products under its Chevron, Texaco, and Caltex brands, providing engine oils, transmission fluids, and industrial lubricants for global markets.

- Eurol: Eurol is an independent Dutch producer of a full range of lubricants, technical fluids, and cleaning products for the automotive, transport, and industrial sectors, known for its "Made in Holland" quality.

- Caltex Lubricants: Operating as a brand under Chevron, Caltex provides a wide array of automotive and industrial lubricants across the Asia-Pacific and Middle East regions, with a focus on engine protection and performance.

- Shell: Shell is the number one global lubricant supplier, offering market-leading lubricants, including advanced engine oils and industrial fluids, to consumers in over 100 countries.

- ENGEN PETROLEUM LTD: Engen produces and markets a comprehensive range of fuels, lubricants, and chemicals across Africa, with offerings spanning automotive, industrial, and marine applications.

- Puma Energy: Puma Energy provides a wide range of quality lubricants for marine, industrial, and automotive use across its global network, particularly in Africa, Latin America, and Asia.

- HP Lubricants: As India's leading lubricants marketer, HP Lubricants offers an extensive portfolio of engine oils, greases, and specialty lubricants for automotive, industrial, mining, and defense applications.

- Petronas: Petronas provides a range of high-performance functional fluids and lubricants for automotive (especially the Petronas Syntium range for passenger cars) and industrial applications globally, leveraging its expertise from Formula 1 involvement.

- Motul: Motul specializes in high-quality, high-performance lubricants primarily for the automotive and motorsports markets, renowned for its expertise in synthetic oils for two-wheelers and performance cars.

-

Lukoil: Lukoil produces and sells a wide range of automotive and industrial lubricants and greases, holding a leading position in the Russian and international lubricants markets.

More Insights in Towards Chemical and Materials:

- 3D Printing Construction Market : The global 3D printing construction market size is calculated at USD 3.59 billion in 2025 and is predicted to increase from USD 6.52 billion in 2026 and is projected to reach around USD 1,389.08 billion by 2035, The market is expanding at a CAGR of 81.44% between 2025 and 2035.

- Ferro Alloys Market : The global ferro alloys market size is calculated at USD 63.34 billion in 2025 and is predicted to increase from USD 68.21 billion in 2026 and is projected to reach around USD 132.88 billion by 2035, The market is expanding at a CAGR of 7.69% between 2025 and 2035.

- GNSS in Agricultural Market : The global GNSS in Agricultural market size is calculated at USD 48.74 billion in 2025 and is predicted to increase from USD 55.34 billion in 2026 and is projected to reach around USD 173.67 billion by 2035, The market is expanding at a CAGR of 13.55% between 2025 and 2035.

- Advanced Composite Materials Market : The global advanced composite materials market size is calculated at USD 45.39 billion in 2025 and is predicted to increase from USD 49.22 billion in 2026 and is projected to reach around USD 102.15 billion by 2035, The market is expanding at a CAGR of 8.45% between 2025 and 2035.

- Biofertilizer Market : The global biofertilizer market size is calculated at USD 3.31 billion in 2025 and is predicted to increase from USD 3.73 billion in 2026 and is projected to reach around USD 11.08 billion by 2035, The market is expanding at a CAGR of 12.85% between 2025 and 2035.

- Artificial Intelligence (AI) in Textile Market : The global artificial intelligence (AI) in textile market size is calculated at USD 4.12 billion in 2025 and is predicted to increase from USD 5.46 billion in 2026 and is projected to reach around USD 68.44 billion by 2035, The market is expanding at a CAGR of 32.45% between 2025 and 2035.

- Technical Textiles Market : The global technical textiles market size is calculated at USD 255.12 billion in 2025 and is predicted to increase from USD 271.83 billion in 2026 and is projected to reach around USD 481.15 billion by 2035. The market is expanding at a CAGR of 6.55% between 2026 and 2035.

- Composites Market : The global composites market size accounted for USD 131.17 billion in 2025 and is predicted to increase from USD 144.43 billion in 2026 to approximately USD 343.64 billion by 2035, growing at a CAGR of 10.11% from 2025 to 2035.

- Nanocellulose Market : The global nanocellulose market size is calculated at USD 766.09 million in 2025 and is predicted to increase from USD 947.96 million in 2026 and is projected to reach around USD 6,447.32 million by 2035, The market is expanding at a CAGR of 23.74% between 2025 and 2035.

- Sulfuric Acid Market : The global sulfuric acid market has expanded to reach approximately 270.84 million tones in 2025 is projected to reach 383.89 million tons by 2035, growing at a CAGR of 3.55% from 2025 to 2035.

-

LNG And FSRU Market : The global LNG And FSRU market size is calculated at USD 145.81 billion in 2025 and is predicted to increase from USD 162.80 billion in 2026 and is projected to reach around USD 438.92 billion by 2035, The market is expanding at a CAGR of 11.65% between 2025 and 2035.

Lubricants Market Top Key Companies:

- TotalEnergies

- CASTROL LIMITED

- AMSOIL INC.

- FUCHS

- Chevron Overseas Limited

- ExxonMobil Corporation

- Eurol

- ENGEN PETROLEUM LTD

- Caltex Lubricants

- Puma Energy

- Shell

- HP Lubricants

- Motul

- Petronas

- Lukoil

Recent Developments

- In October 2025, SK Enmove and Gabriel India Limited (an ANAND Group Subsidiary) announced the formation of a joint venture to distribute engine oils, industrial lubricants, and EV-specific premium fluids in India. This move signals a strategic push into the margining of India's mobility and EV lubricant segment.

- In July 2025, Shell Lubricants completed the acquisition of Raj Petro Specialities Pvt Ltd in India, strengthening its local manufacturing footprint and product portfolio. The deal brings Shell deeper into India’s lubricant market by adding Raj Petro’s plants and a broader range of specialty oils across sectors.

- In July 2024, AMSOIL INC. launched a new synthetic blend motor oil product line for installers. The latest Synthetic-Blend Motor Oil is available in three viscosities and has more than 50% synthetic content. It offers motorists better performance and protection compared to conventional oils. It is designed with high-quality components that protect modern engines, including direct injection and turbochargers. AMSOIL Synthetic-Blend Motor Oil has three viscosities: 5W-20, 5W-30, and 0W-20.

Lubricants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Lubricants Market

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2019 - 2034)

- Mineral Oil

- Synthetic Oil

- Bio-Based Oils

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2019 - 2034)

- Industrial

- Process Oils

- General Industrial Oils

- Metalworking Fluids

- Industrial Engine Oil

- Greases

- Process Oils

- Other Industrials

- Automotive

- Engine Oil

- Gear Oil

- Transmission Fluids

- Brake Fluids

- Coolants

- Greases

- Marines

- Engine Oil

- Hydraulic Oil

- Gear Oil

- Turbine Oil

- Greases

- Others

- Aerospace

- Gas Turbine Oil

- Piston Engine Oil

- Hydraulic Fluids

- Others

- Industrial

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report https://www.towardschemandmaterials.com/checkout/5648

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.